Purchase Expense Booking Process

To maintain accurate stock quantities in ERPNext while correctly booking expenses in accounts.

Use Case

This process is used when :

- Inventory (Consumables) quantity needs to be tracked

- Expense needs to be booked immediately after purchase.

- Stock valuation impact is not required, or expenses should not be delayed until the time of consumption.

Detailed Steps

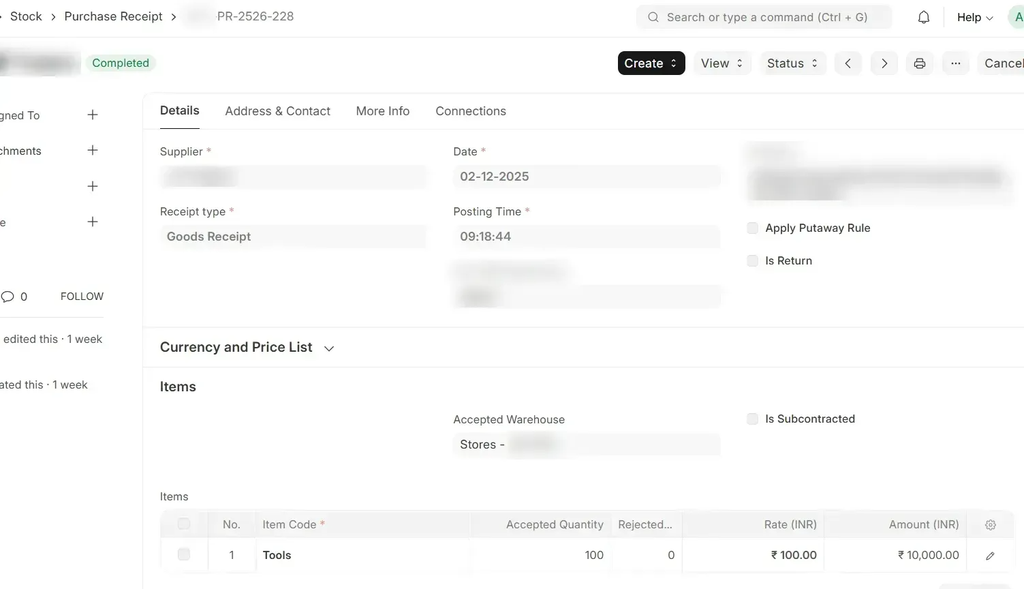

Create a Purchase Receipt (consumable items) and the stock will updated as usual.

Stock ledger:

Stock ledger:

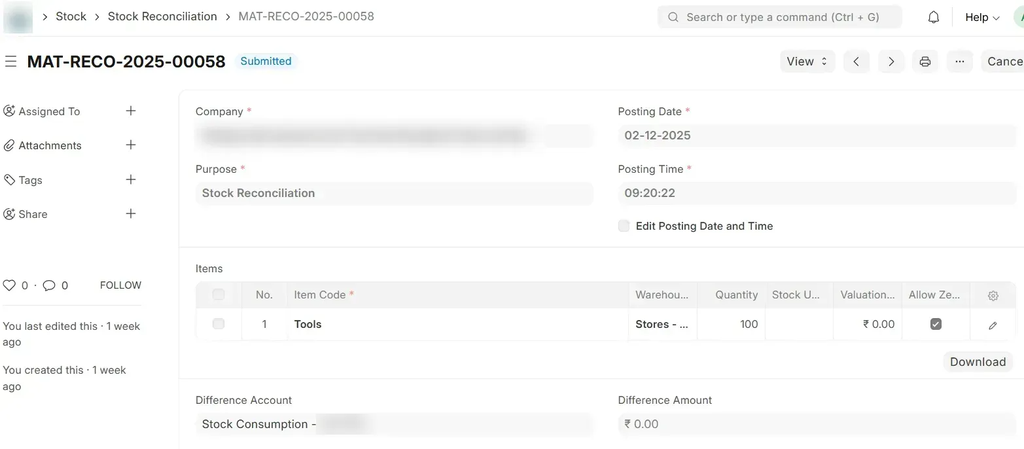

Stock Reconciliation:

- Select item and warehosue, Set Valuation Rate = 0 and Select difference expense account.

- Save and Submit.

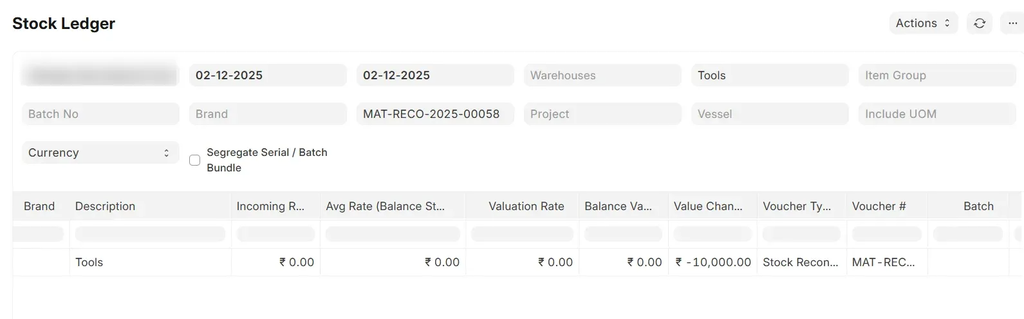

Stock Entry after stock reconciliation:

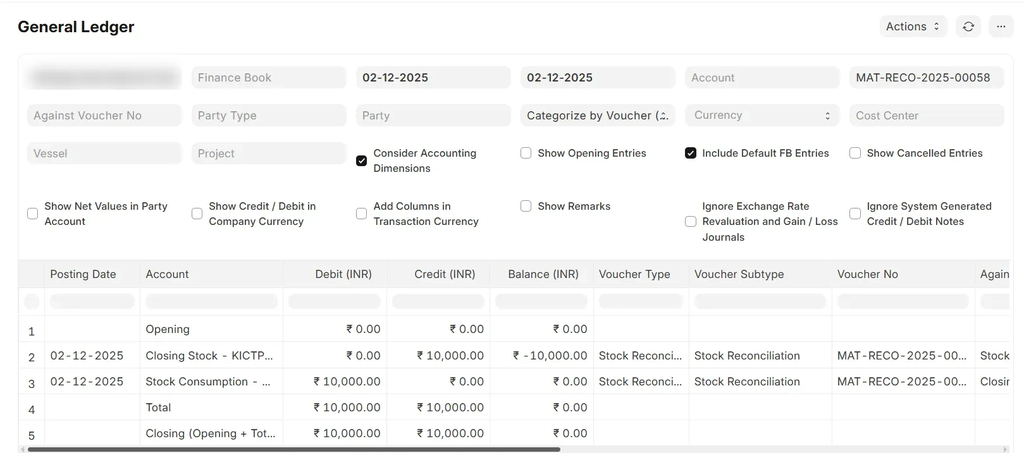

General Ledger:

General Ledger:

- Select item and warehosue, Set Valuation Rate = 0 and Select difference expense account.

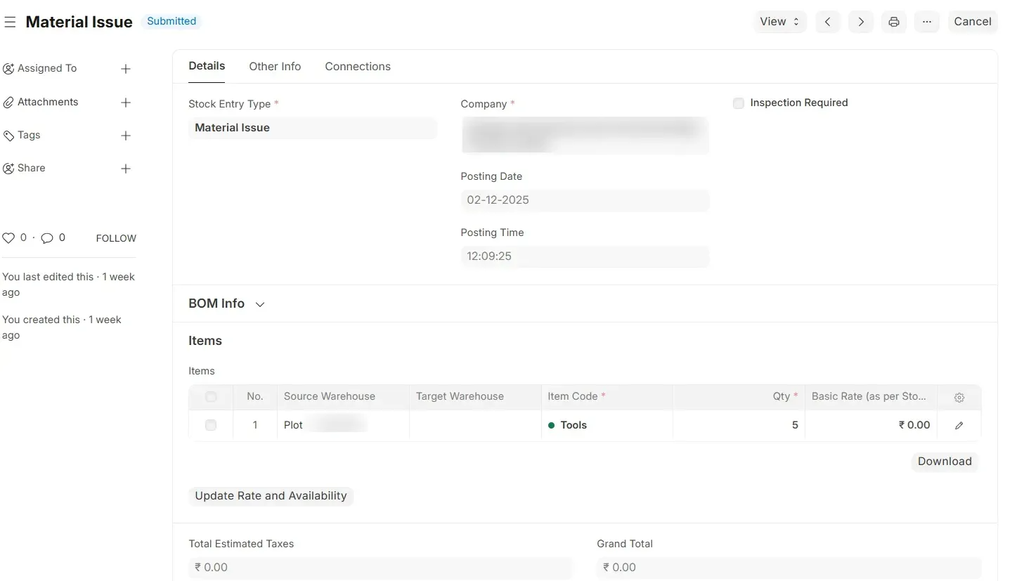

Material Issue entry:

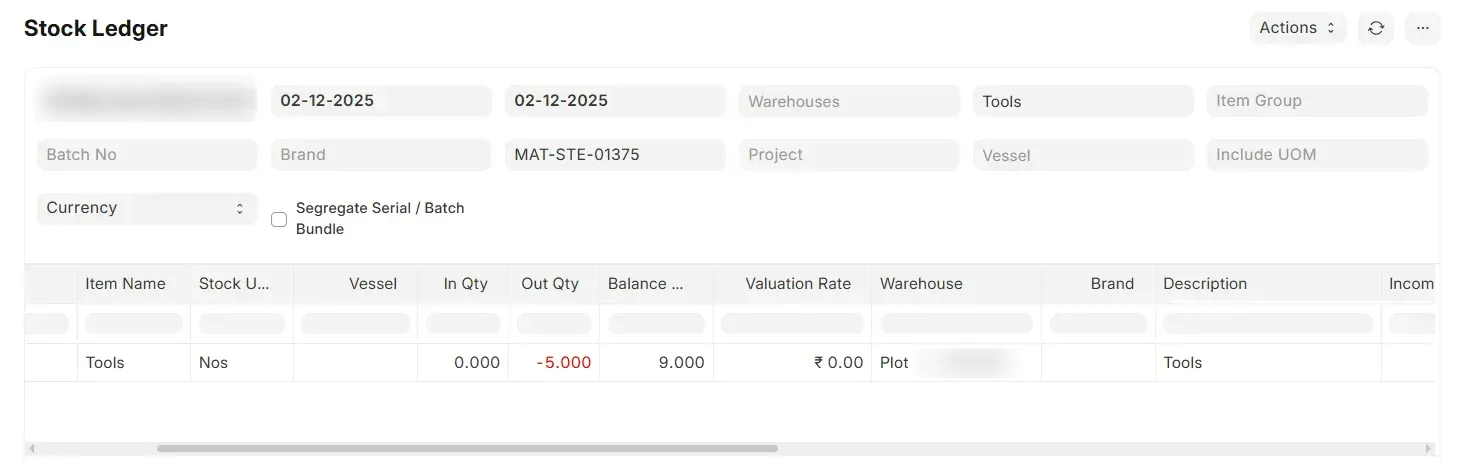

Stock ledger:

Stock ledger:

Reports

- Stock Balance Report

- Stock Ledger

- General Ledger

Outcome:

- Stock quantity is updated

- Proper expense booking in accounts

- No inventory valuation impact

- Alignment between stock and financial records

Key Notes

- Zero valuation is recommended only for expense tracking, not for inventory valuation

- Ensure correct expense account mapping.

Conclusion

This process ensures inventory control without impacting valuation when only quantity tracking is required.